For Brock Taylor, sales and lettings in 2017 have been our busiest on record, but what about a complete overview of the Horsham market? Using leading property statistics from Data Loft,...

For Brock Taylor, sales and lettings in 2017 have been our busiest on record, but what about a complete overview of the Horsham market? Using leading property statistics from Data Loft, we’ve created a report of the last 12 months to highlight national and regional trends.

Market review 2017

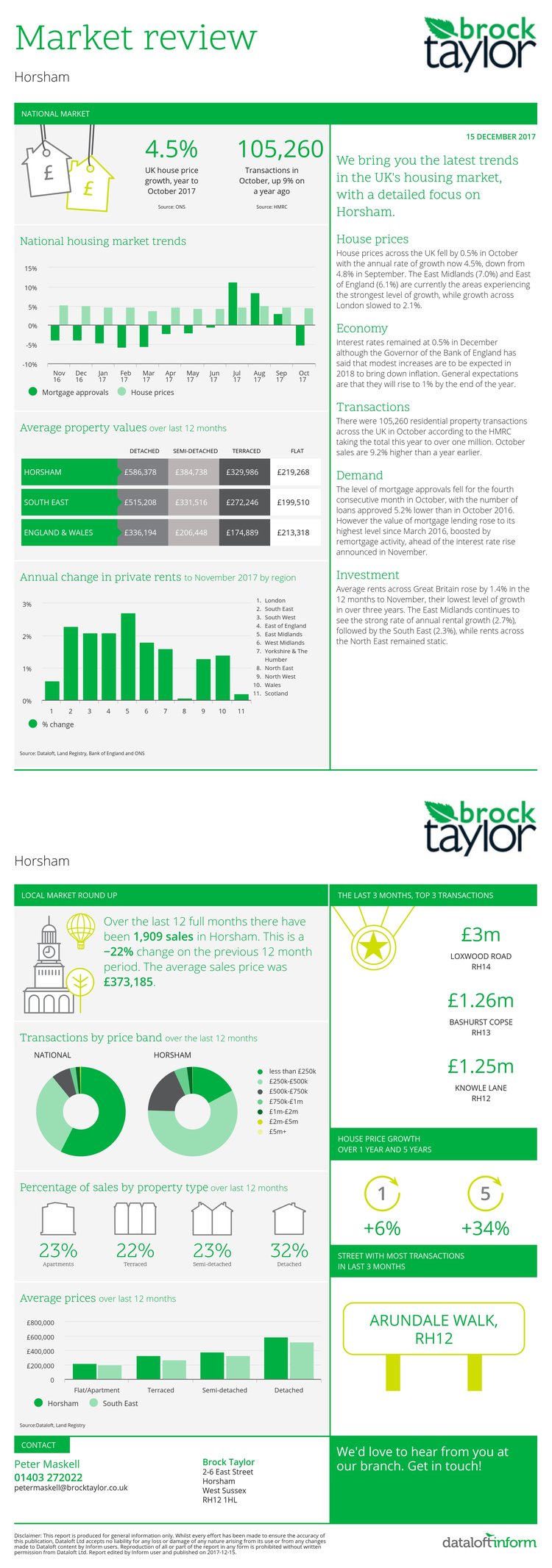

House prices increased 6% in 2017

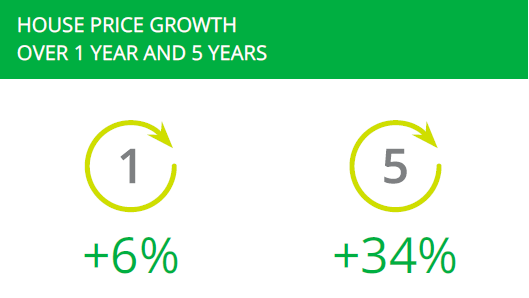

Horsham’s steady market growth continued in 2017 with an average price increase of 6% across the district. This growth shows 10% more increase than the national increase of 5.4% in the UK. This reflects the average prices for flats/apartments, terraced, semi-detached and detached property types all being above the national average, according to the Land Registry.

Such a trend puts confidence into the Horsham property market and for the rental sector, landlords can see a clear return on investment from buy to let: in 2017, the average property price increased to £373, 185 from 2016 figures.

Property market 2018

New build targets

Looking ahead, the Government recently announced in their budget a commitment to build 300,000 homes a year to relieve pressure on the shortage of housing. The number of homes to be built in the Horsham District under this scheme in 2018 is currently unknown but it should help first time buyers get onto the property ladder.

Brexit resilience

Of course, there are also national economic factors from Brexit talks that we will pay close attention to. However, the market looks resilient and steady for 2018 and with developments in the town centre (Piries Place Shopping Centre and redevelopment of Swan Walk) planned to further improve local services, the appeal of Horsham can only grow.

Stamp duty change for first time buyers

In November 2017 Philip Hammond, Chancellor of the Exchequer, announced that first time buyers who no longer pay stamp duty on properties up to the value of £300,000 and those buyers spending up to £500,000 will only be charged on the amount over the new £300,000 threshold.

It’s estimated this suspension of stamp duty will exempt 80% of all first time buyers from the tax, encouraging and enabling new entrants to the property market. The average first time buyer in the UK could save £1,660.

Get in touch

Peter Maskell, Brock Taylor director, states, “This year has been challenging for many businesses within the property sector, primarily due to the increased pressure on fees and reduced number of overall transactions. Therefore, it is testament to the high calibre and commitment of the staff at Brock Taylor that in spite of this we have recorded a record year.

I am sure that with the continuing distraction of Brexit, together with an expected further rise in interest rates that next year will be similar, although both myself and my team are committed to making additional gains in the local market, whilst still providing outstanding customer service.”

To rent or sell your property in 2018, please contact our friendly teams on 01403 272022 (for sales) or 01403 272002 (for lettings).

Our East Street Branch is open Monday to Thursday 8:30am to 6.30pm, Friday 8:30am to 6pm, Saturday 9am to 5pm and Sunday 10am to 4pm.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link